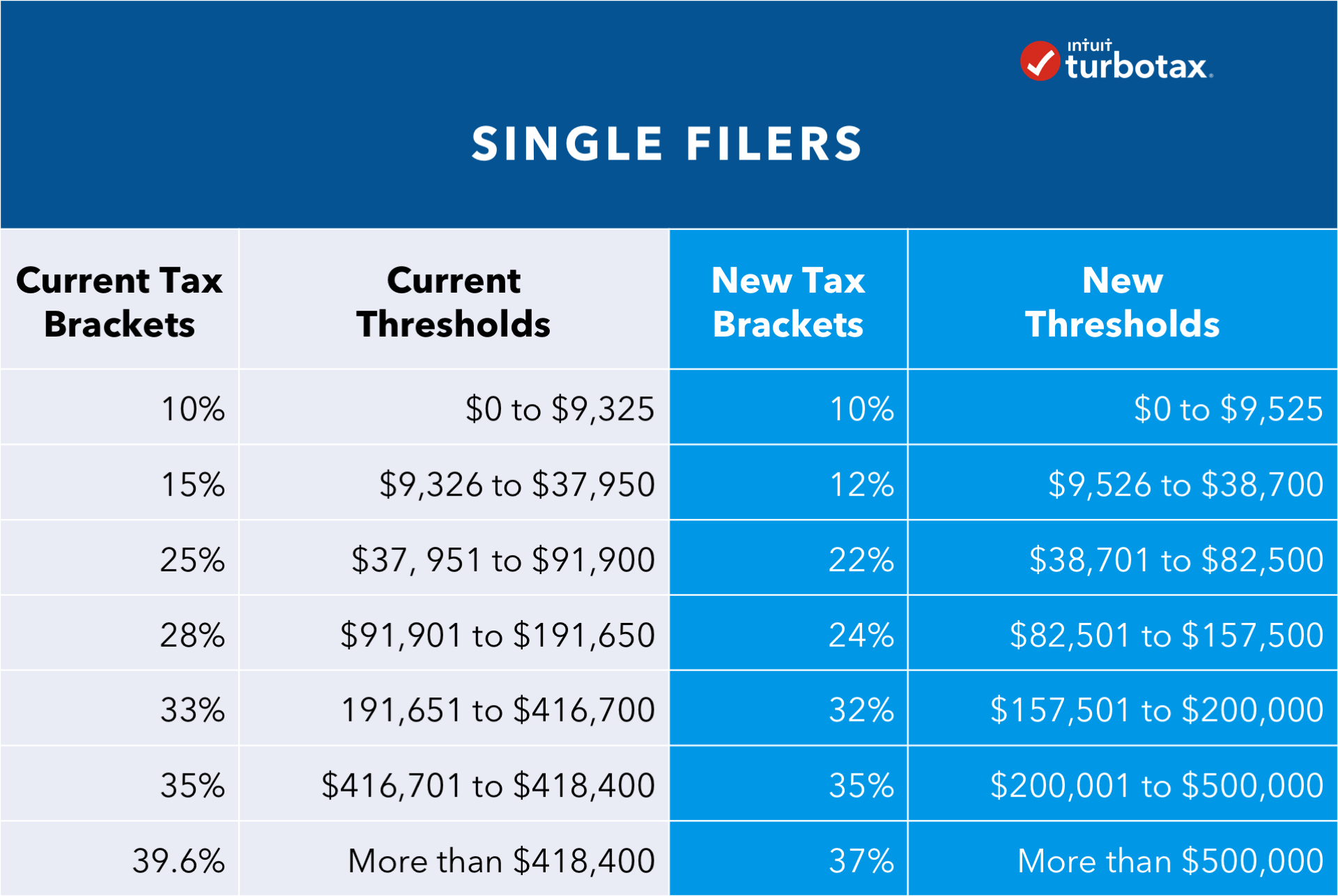

2025 Tax Brackets Single - 2025 Standard Deduction Over 65 Tax Brackets Alysa Bertina, 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Federal Tax Brackets 2025 Single Lucy Simone, As your income goes up, the tax rate on the next.

2025 Standard Deduction Over 65 Tax Brackets Alysa Bertina, 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

When Can I File My Taxes For 2025 Turbotax Clio Melody, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

2025 Tax Brackets Single Over 65 Dynah Virginia, Meanwhile, the lowest threshold of 10% applies to those making.

2025 Tax Brackets Single. — as noted earlier, the 2025 federal income tax rates consist of seven brackets: — for the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Tax Brackets Single Filing Ailene Jackquelin, The tax brackets consist of the following marginal rates:

2025 Tax Brackets Mfj Roch Violet, For instance, the 22% tax bracket for single filers applies to $50,650 of income for the 2025 tax year (i.e., income from $44,726 to $95,375), but it applies to $53,375 of income for.

2025 Tax Brackets Single With Kid Kelsy Atlanta, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Bracket 2025 Jamima Selina, The tax brackets consist of the following marginal rates:

2025 Tax Brackets Single With Kid Kelsy Atlanta, — federal income tax rates and brackets.

— yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they. Given many people are interested in the changes, we wanted to include the latest tax bracket.